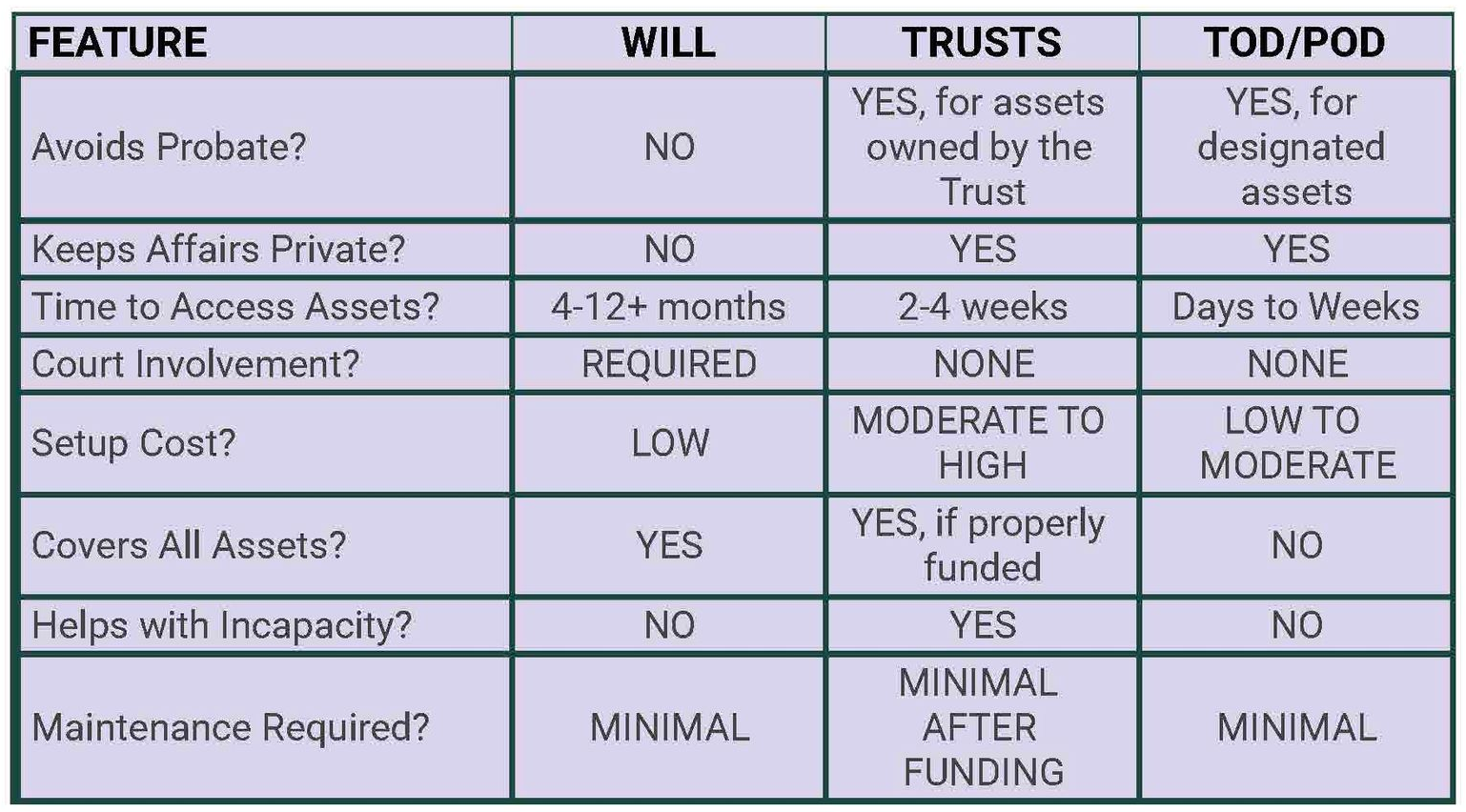

Wills vs. Trusts vs. Beneficiary Designations

WHICH IS BEST?

If you're trying to avoid probate in Ohio, you've probably heard about wills, trusts, and transfer on death deeds. But here's the thing, not all of these actually help you skip probate. In fact, one of them will guarantee your family ends up in probate court.

Let me break down what really works and what doesn't, so you can make the best choice for your Ohio estate.

The Truth About Wills and Probate

Here's what might surprise you: wills don't avoid probate at all. Actually, they're the reason your estate goes through probate in the first place.

When you die with a will in Ohio, your executor has to file that will with the probate court. The court then supervises the entire process of notifying heirs, paying debts, inventorying assets, and distributing everything according to your wishes. This typically takes 4-12 months (sometimes much longer), costs money in court fees and attorney fees, and makes your financial business public record.

Think of a will like a set of instructions for the probate court. It tells the judge what you wanted, but the court still has to follow the formal legal process to make it happen. Your family can't just take your will to the bank and start moving money around, they need court approval.

So if avoiding probate is your goal, a will alone won't get you there. But that doesn't mean wills are useless. They're still important for naming guardians for minor children and handling any assets that don't have other beneficiary designations.

Revocable Living Trusts: The Probate-Avoiding Champion

Now we're talking about something that actually works. A revocable living trust is probably the most comprehensive way to avoid probate in Ohio. Here's how it works: you create a trust document and transfer your assets into it while you're alive. You can be the trustee (the person who manages it), so you don't lose any control. When you die, your successor trustee takes over and distributes everything according to your instructions, no court involvement needed.

The major benefits:

- Complete probate avoidance for assets in the trust

- Privacy, trust administration stays out of public records

- Speed, assets can be distributed in weeks instead of months

- Incapacity protection, if you become unable to manage your affairs, your successor trustee steps in without needing court guardianship proceedings

- Flexibility, you can change or revoke the trust anytime while you're alive

The downsides:

- Cost, trusts are more expensive to set up than basic wills

- Maintenance, you need to actually transfer assets into the trust (called "funding" the trust)

- Complexity, more moving parts than simple estate planning tools

Let's say Sarah owns a house, has $200,000 in bank accounts, and some investment accounts. She creates a revocable living trust, transfers the house deed into the trust's name, and changes the bank and investment accounts to the trust's name too. When Sarah dies, her daughter can access everything immediately through the trust, no probate needed.

Transfer on Death Deeds: The Targeted Solution

Transfer on death (TOD) designations and deeds are like surgical strikes against probate, they work great for specific assets but don't cover everything.

Ohio allows you to add TOD designations to:

- Bank accounts (also called payable-on-death or POD)

- Investment and retirement accounts

- Vehicles (through the BMV)

- Real estate (through survivorship or TOD deeds)

When you die, these assets automatically transfer to your named beneficiaries without any court involvement.

The benefits:

- Simple and inexpensive to set up

- Complete probate avoidance for those specific assets

- Privacy, transfers happen outside of court

- Speed, beneficiaries can usually access assets within days or weeks

The limitations:

- Limited scope, only works for certain types of assets

- No incapacity planning, doesn't help if you become unable to manage your affairs

- Potential complications if beneficiaries die before you

What Works Best for Different Situations

If you want the most comprehensive probate avoidance: Go with a revocable living trust. Yes, it costs more upfront, but it handles everything: probate avoidance, privacy, incapacity planning, and flexibility. This is especially smart if you have substantial assets or real estate in multiple states or young beneficiaries.

If you have a simple estate: You combine a basic will with TOD designations on your accounts and vehicles. Add POD beneficiaries to your bank accounts, make sure your retirement accounts have current beneficiaries, and consider a survivorship or TOD deed for your house. This approach is cost-effective and handles many, but not all, situations. It does not help with incapacity planning.

If you own real estate: Don't overlook survivorship deeds. They're relatively inexpensive and keep your house out of probate entirely. Just make sure you work with someone who knows Ohio's requirements for the survivorship language.

If you have complex family situations: A trust gives you more control over when and how beneficiaries receive assets. You can set up provisions for minor children, protect spendthrift beneficiaries, or create incentive provisions.

Common Mistakes to Avoid

I see families make the same mistakes over and over:

Thinking a will avoids probate. It doesn't. If you think a will avoids probate, think again.

Creating a trust but not funding it. A trust is just a piece of paper unless you actually transfer assets into it. If you die with assets still in your individual name, those assets still go through probate.

Forgetting to update beneficiaries. Your ex-spouse probably shouldn't be the beneficiary on your 401(k). Review and update beneficiary designations regularly.

Using the wrong language on deeds. Ohio has specific requirements for survivorship deeds. Generic language from the internet might not work.

The Bottom Line

If you want to avoid Ohio probate, you have good options: you just need to choose the right tool for your situation. Wills are great for many things, but probate avoidance isn't one of them. Trusts offer the most comprehensive solution, while TOD tools work well for targeted assets. The key is understanding that there's no one-size-fits-all answer. Your best strategy might be combining several approaches: maybe a trust for major assets, POD designations on accounts, and a TOD designation for your vehicles.

Estate planning doesn't have to be overwhelming, but it does need to be done right. The good news is that with proper planning, you can save your family time, money, and stress during an already difficult time. Planning your estate to avoid probate in Ohio? The Law Offices of Laura Blumenstiel can help you explore your options and create a plan that works for your family's unique situation. Contact us to discuss which approach makes the most sense for you. In the meantime, check out this handy chart.